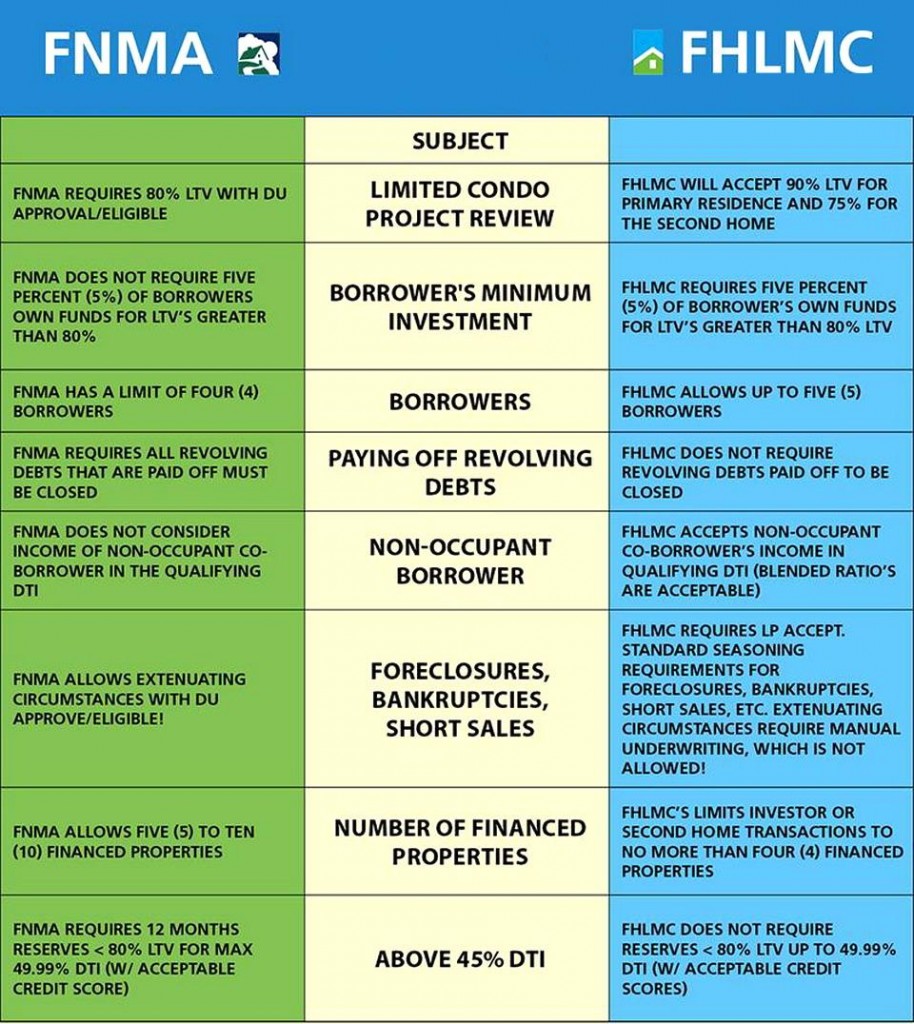

For the more savvy borrowers and investors, I decided to post this comprehensive comparison chart between Fannie Mae and Freddie Mac. The chart illustrates the differences between both companies ‘loan qualifying criteria’ required of the loans they purchase.

Please keep in mind that some of these lending rules are not cast in stone and those do change over time. As lenders, we must understand and stay informed and current with all the new laws and regulations if we are to continue originating, funding and successfully closing your escrows. Some may find this information helpful, while others will learn something new.

HOME LOAN PROGRAM QUALIFYING GUIDELINE COMPARISON

The center column shows the Subject Categories while the left and right columns indicate the differences between the loan lending guidelines required by Fannie Mae and Freddie Mac respectively. Not all loans are created equal…

ABOUT FANNIE MAE and FREDDIE MAC

Fannie and Freddie are special: They are government-chartered companies (“government sponsored entities”, or GSEs), with narrow federal mandates: to provide finance for single- and multi-family housing. They are publicly traded companies with private shareholders. Both are large. At year-end 2000, Fannie had $675 billion in assets; Freddie had $459 billion. When ranked by assets, at that time they were the third- and fifth-largest “private” enterprises in the U.S.

FANNIE MAE

The Federal National Mortgage Association is more commonly known as Fannie Mae, abbreviated ‘FNMA’. It was founded in 1938 during the Great Depression. It is in fact a government-sponsored enterprise (GSE) and in 1968 became publicly traded. The primary purpose for the creation of FNMA was to expand the secondary mortgage market by securitizing mortgages in the form of mortgage-backed securities, or MBS. The MBS allowed lenders to reinvest their assets into more available funding dollars and effect the increase number of lenders in the mortgage market place. FNMA also reduced the reliance on locally-based savings and loan associations, aka “thrifts & loans”. FNMA does not make loans directly to consumers, or homebuyers.

FREDDIE MAC

The Federal Home Loan Mortgage Corporation is more commonly known as Freddie Mac, abbreviated ‘FHLMC’. It was founded in 1970 to further expand the secondary market for mortgages in the US. It is also a public government-sponsored enterprise (GSE). With the mortgages they buy in the secondary market, Freddie Mac pools and sells them as a mortgage-backed security to investors on the open market. This secondary mortgage market increases the money supply making more funds available for mortgage lending and new home purchases. Freddie Mac does not make loans directly to consumers, or homebuyers.

Below are some of the key highlights from one of our better Wholesale Lenders. Take a look…

Jumbo Highlights

• Loan amounts from $417,001 – $3M (more on exception)

• Interest Only to $2M at 80% LTV

• 90% with NO MI to $1.5M

• Primary Residence, Second Home and Investment

• Cash Out Available up to $2.5M (50% LTV)

• 80% LTV to $2M

• Cash out to 60% LTV on Investment AH 5/1 ARM

• Gift Funds for Down Payment regardless of Occupancy

• Low FICO Score Requirements – 660

• Ratios – Max DTI 50%

• Property Types – SFR, PUD, 1-4 Units, Condos

• “Make Sense” Underwriting Guidelines

• Asset Depletion for Income Qualifying

• Use of Business Funds for Down Payment and Closing Costs is Acceptable

• Retirement for Reserves

• Subordinate Financing OK

• Call for Exceptions!

Fannie Mae Highlights

• No Overlays

• Loan Amounts to High Balance Limits Per County

• 100% Gift Allowed, regardless of LTV (not applicable to High Balance)

• No Max DTI, Follow DU

• Up to 10 Financed Properties on 2nd Home and Non-Owner

• Unlimited Financed Properties on Owner Occupied Transactions

• 4 Years on Short Sales no 80% LTV restriction

• W2 Validation/Transcripts Permitted

• DU Refi Plus to Unlimited LTV, No Minimum FICO

• Minimum FICO Score 620

• No Landlord Experience Required for Rental Income

• Cash-Out within 6 Months

• Asset Depletion

• Limited Condo Reviews to 80% LTV

Freddie Mac Highlights

• Only 1 Borrower Required to have a Usable Score

• Blended Ratios with a Non-Occupant Co-Borrower

• Streamlined Condo Reviews on Owner to 90% LTV

• 620 Min FICO, including Super Conforming

• Super Conforming Investment Purchase to 80% LTV

• Max DTI 50% LTV

• Gift Funds OK with 5% Occupant Borrower Contribution

• Delayed Financing (Cash-Out within 6 Months)

• Unlimited Financed Properties on Owner Occupied

• Employment Contracts for Salaried Borrowers OK with VOE Prior to Close

FHA Highlights

• 580+ FICO Score to 96.5% LTV Purchase or 97.75% LTV Rate & Term or 85% LTV Cash-Out

• 580 Minimum FICO on Flips or High Balance

• No DTI Restrictions, Follow AUS

• Collections Only Need to be Paid if Required by AUS

• No Minimum Credit History or Trade Lines with AUS Approval

• No VOR Unless Required by DU Findings

• Non-Occupant Co-Signers to Help Qualify

• Mortgage Lates OK if AUS Approved

• Borrower with Work Permits/Non-Resident Aliens OK

• Rental Income on 2-4 Unit Properties OK for 1st Time Homebuyers.