NEW REAL ESTATE LAWS

Transfer Tax Disclosure Requirement – AB 1888

Effective January 1, 2015

A new California law now in effect requires the documentary transfer tax to be included on the face of the property deed. Prior to the enactment of this new law, it was not uncommon in commercial real estate (and also in some residential sales transactions) to provide the amount of documentary transfer tax via an ‘unrecorded declaration’ all in an effort to prevent a final purchase price from being readily ascertainable. In other words, some Buyers did not want the world to know. Fast forward to January 1, 2015 the amendments enacted by AB 1888 eliminated this practice.

Under this new law, not only is the location of the property required to be printed on the face of the deed, but the amount of the transfer tax due as well. Additionally, pending purchases and sales transactions were not exempted from this requirement.

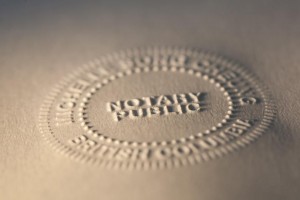

New Notary Acknowledgement – SB 1050

All notary acknowledgements must now include the following prescribed consumer disclosure enclosed in a box at the top of each certificate:

A notary public or other officer completing this certificate verifies only the identity of the individual who signed the documents, to which this certificate is

attached, and not the truthfulness, accuracy, or validity of that document. This list is not an exhaustive list of all new real estate legislation effective 2015, but rather a list of new legislation directly affecting the business of title and escrow.