Good News for Home Buyers

FHA Reduces Annual MIP Rates by .50 Basis Points

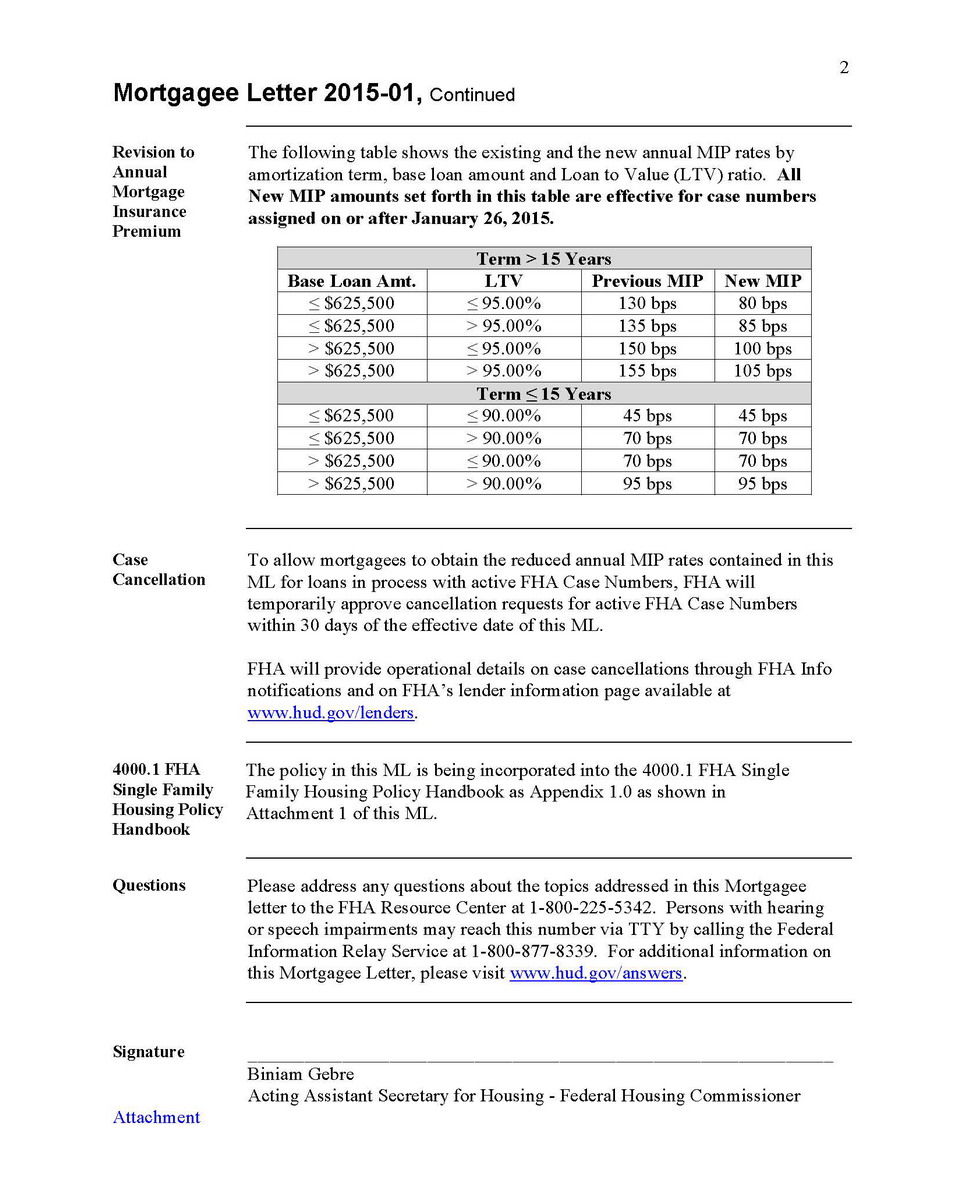

A good start for 2015. Just recently HUD announced a reduction to their Annual MIP rate for loans with amortization terms longer than 15 years. What this means is not only the lowering of the annual premium by 50 basis points, but also the financed total loan amount. These changes will take effect for new FHA case numbers assigned on or after January 26th, 2015.

What does this really mean for Home Buyers?

With the Annual MIP reduction, FHA has made it less expensive for buyers to obtain financing up to 96.5% loan-to-value (LTV). This really is great news as FHA continues to be the most flexible lending program for home buyers and borrowers alike using less than a 5 percent as a down payment. Keep in mind that with expanded lending guidelines, some lenders are also able to further help some borrowers with low FICO scores down to the 580 point range.

Should you have any questions regarding these changes, or would like to discuss how I can help you qualify for a home loan, please don’t hesitate to contact me.